Think about the international graduate students you recruit. Do you know how they are funding their studies? Do you know what the true cost of attendance is for your program(s)? Would you be able to tell a student from Nigeria in your pipeline what their options are for funding their studies at your school? Would you know where to point them to for resources?

If the answer to any of these questions is “no,” don’t be too hard on yourself! Discussing funding as part of the admissions process hasn’t always been necessary.

However, we’re increasingly finding that students are seeking this information earlier in the admission process, so equipping your teams with the skills and resources to engage aspiring students in these conversations can significantly impact the recruitment process and outcomes for your enrollment goals - as well as the very real students making life changing decisions behind them.

International Student Enrollment After the Pandemic

In the early stages of the pandemic, institutions and academic programs did not hesitate to create accessible pathways for international students to apply (and eventually enroll) in recognition of the critical need for their numbers and tuition fees.

These pathways included fee and testing waivers, more generous scholarship packages, additional intakes, and increased flexibility and sensitivity to personal circumstances.

We’ve now declared that international student numbers have officially rebounded from their initial 15% pandemic dip. However, the financial situations most applicants face likely have not.

The global economic impact of the last 3 years, along with the temporary pathways created to incentivize international enrollment, has encouraged more diverse demographics of aspirants towards graduate degrees.

These prospective international graduate students are now increasingly coming from families that may have lost a job, a primary earner, or large assets due to COVID-19 - or from nations whose economies are still impacted by continued lockdowns, economic instability, or their political climate.

These applicants will increasingly rely on scholarships, assistantships, and financial options as they look to graduate degrees as a way to better their financial position. Are your admissions teams prepared to have candid and realistic conversations about their continued needs?

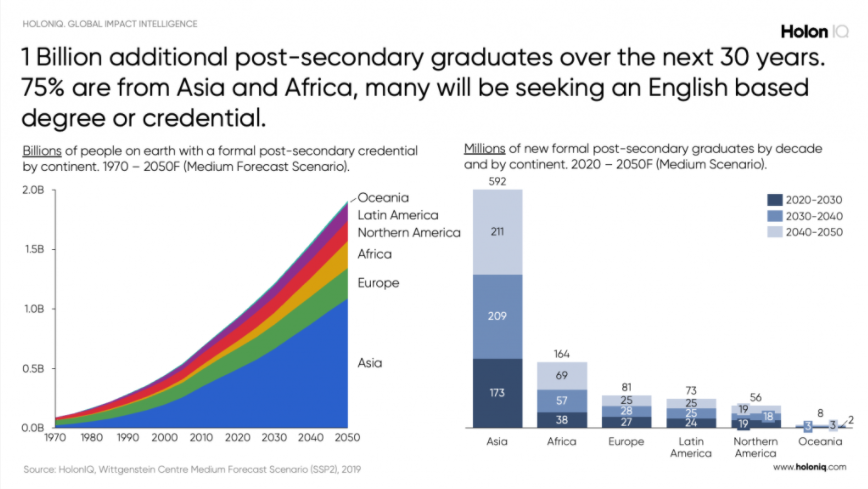

Holon IQ predicts 1 billion additional post-secondary graduates over the next 30 years, primarily from Asia and Africa, seeking English based degrees.

Holon IQ predicts 1 billion additional post-secondary graduates over the next 30 years, primarily from Asia and Africa, seeking English based degrees.

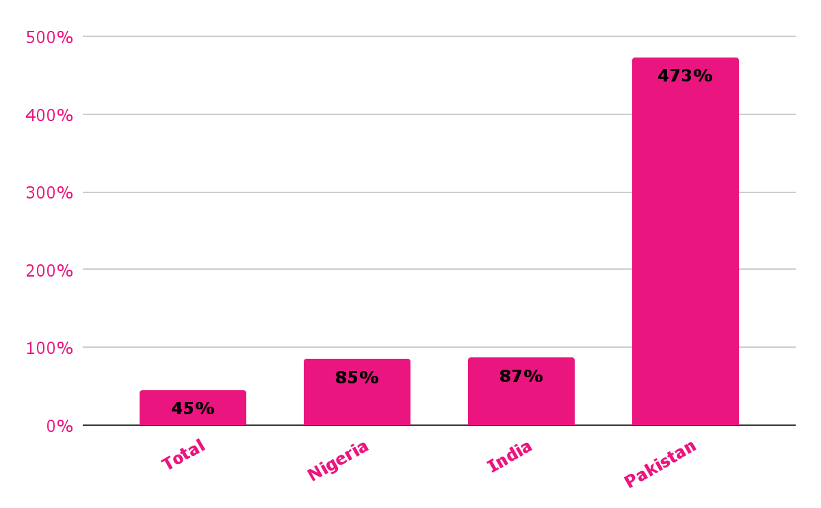

Prodigy Finance Year over Year (2021-2022) website growth by explorer region

Prodigy Finance Year over Year (2021-2022) website growth by explorer region

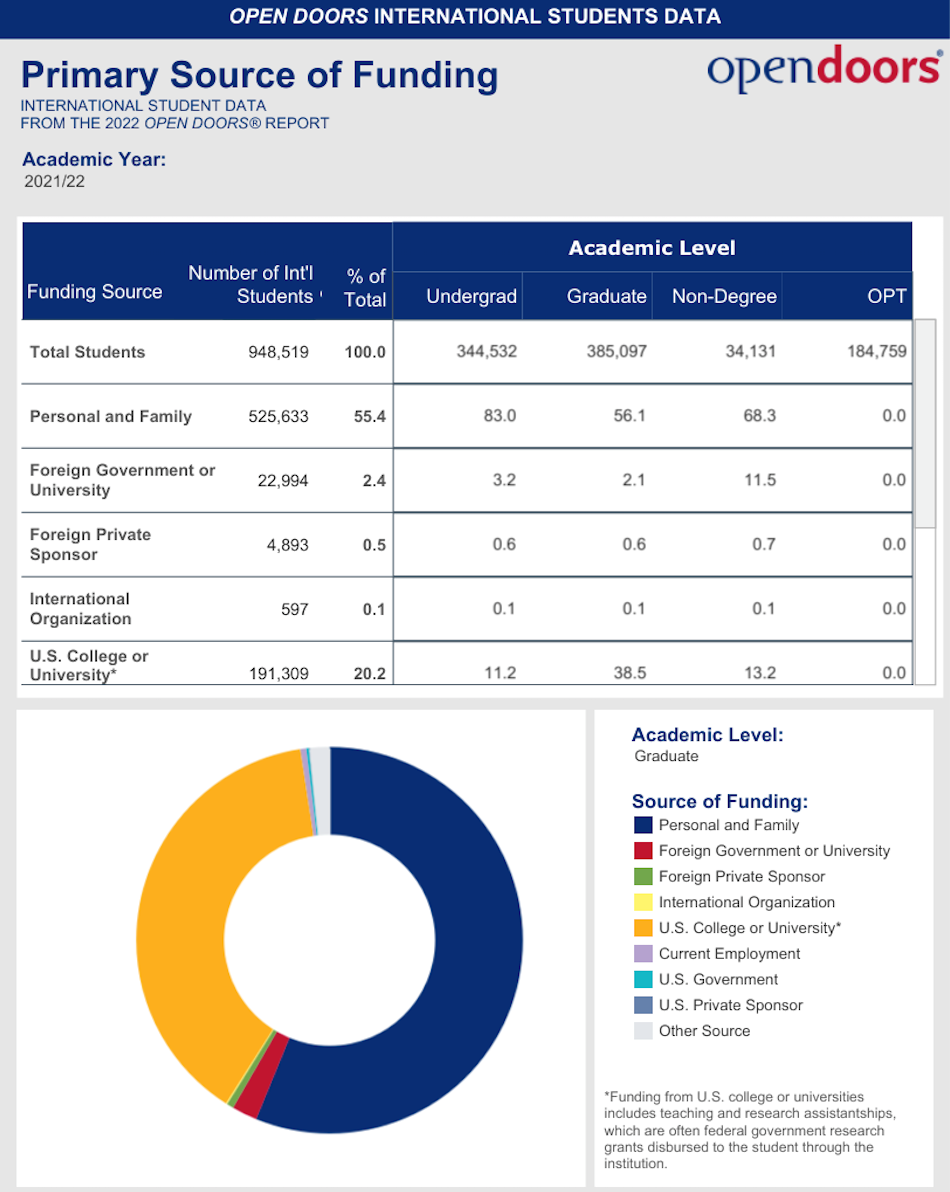

Funding, especially for international students, is a historically hidden and taboo topic outside of the financial aid office (and sometimes even within financial aid!). Data from the Institute of International Education’s 2022 Open Doors Report on international students' “primary source of funding” shows that 56% of graduate students are “personally or family funded.”

This is a vague category that has not traditionally been unpacked, but typically means that over half of all international graduate students coming to the US are using a combination of savings and loans.

This broad and unexplored piece of the pie has unfortunately led to the assumption that international students just organically “figured out” how to pay for their degrees, but what we’re now seeing is that rising tuition costs, fewer scholarships, and enrollment strategies that increasingly call for a more diverse and internationalized classes, are forcing conversations around what “personally” funded actually entails.

Institute of International Education (2022). “International Students by Primary Source of Funding” – Graduate. Open Doors Report on International Education Exchange.

Institute of International Education (2022). “International Students by Primary Source of Funding” – Graduate. Open Doors Report on International Education Exchange.

Financial Challenges for International Students

Current Funding Limitations

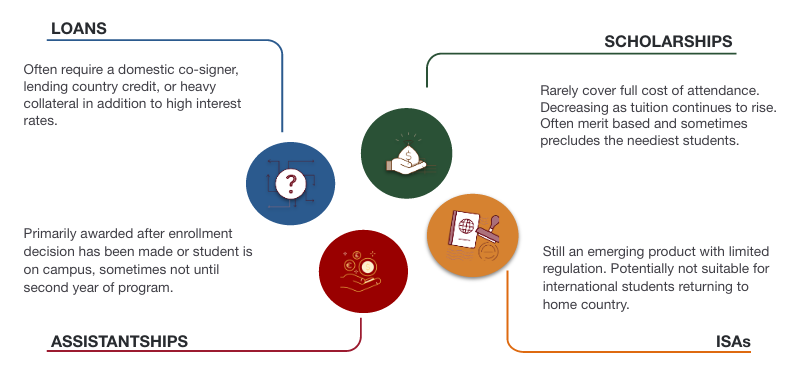

So what options are currently available to international students? A true international student is not eligible for US financial aid, and most US and home country private lenders require a co-signer, collateral, and credit established in the applicant’s host country, providing significant barriers to most students.

Scholarships are few and far between for these students, and rarely cover the full cost of attendance. These are often merit based and therefore generally preclude the neediest students. Assistantships are primarily awarded after enrollment decisions are made or a student is on campus - typically not until their second year - and therefore can’t necessarily be factored in as a guarantee when planning a budget. Income Share Agreements are still new with limited regulation and are not always suitable for an international student planning to return to their home country.

Institutional Roadblocks

Bureaucracy, outdated policies, stale ways of thinking, siloed systems, and individual administrators can all lead to general institutional challenges in getting funding resources directly in the hands of international students. Possible roadblocks include:

- The full range of funding options for international students are not considered: only scholarships and/or assistantship information is shared,

- Disconnect between teams, historic policies & offices (Financial Aid vs Enrollment),

- Buried or lack of financial information specifically for international students; all student info is lumped together when the same services aren’t available to international students,

- Uninformed recruiters and admissions teams – who may have a lack of knowledge of where resources exist, or may give the impression they are unavailable,

- If addressed, financing information is only provided after admission – both parties invest a great deal of time and energy only to find out after the fact that it won’t work out,

- Some forms of funding are not accepted as “proof of funds” for I-20 issuance – leading students to artificially inflate their reported savings or bank account balances.

The Impact of Funding Conversations on Recruitment and Student Decision Making

Admissions teams need to feel comfortable, encouraged, and empowered to talk about finances to a certain degree because it is increasingly part of the student recruitment and decision-making process - whether the administrator acknowledges this or not.

Entering into conversation with students and going so far as to provide them with the tools they need to make their own best-fit decisions can go a long way in building relationships, trust, reputation, and ultimately stronger and more diverse enrollments.

A few ways to do so include:

- Offering funding webinars for prospective and admitted students before they make their enrollment decision,

- Having general information on-hand and not sending the student on a hunt across administrative offices,

- Connecting enrolled students to funding resources to help them manage their debt and personal finances so they can stay enrolled and successful in their time on campus - avoiding scams, establishing credit, and budgeting effectively.

Beyond the increasing need for international students to have financial options, there is also an element of want. A student may receive a scholarship to a lower choice program, and may not have similar options to access your program.

Providing them with outside funding options like private loans and external scholarships could help empower them to be able to choose your program as their top choice.

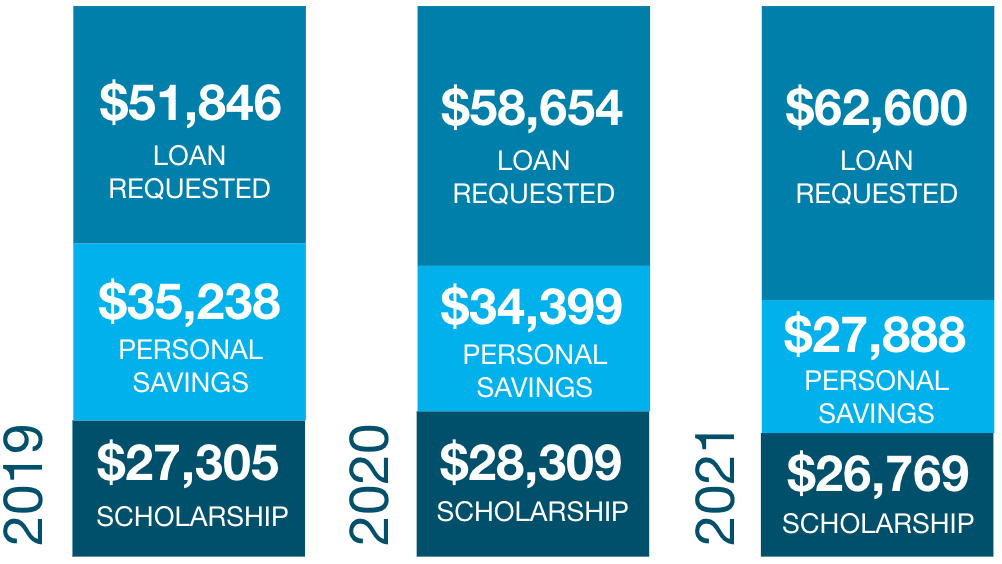

Prodigy Finance loan application data 2019-2021 demonstrates reported rises in tuition, decreased scholarships, and limited personal savings. It is clear that as international graduate student needs and backgrounds continue to shift, access to funding will be a critical piece of the recruitment process.

Prodigy Finance loan application data 2019-2021 demonstrates reported rises in tuition, decreased scholarships, and limited personal savings. It is clear that as international graduate student needs and backgrounds continue to shift, access to funding will be a critical piece of the recruitment process.

Empowering students with funding information and options opens pathways; it

- Allows students to choose best-fit programs and schools,

- Provides accessible education for lower- and middle-income students,

- Creates larger applicant pools and more competition,

- In turn leading to more diverse cohorts, richer classroom experiences, and enhanced learning,

- Ultimately bolsters the reputation, brand, and interest in your programs.

Addressing Barriers

So, how can you and your teams immediately start supporting your prospective students in their pursuit of education funding?

Quick Action for Big Impact

- Don’t make prospective students dig for information: list funding options and resources on your admissions pages, and if possible, have a specific page for international students,

- Equip recruiters and advisors with base level knowledge and ease of funding options, even if that is something like “Yes, we have funding resources for international students, let me connect you with XX in Financial Aid”,

- The above, then, naturally requires a level of connectedness and collaboration with financial aid teams and resources – evaluate how you can pool your resources,

- Recognize that the majority of students will need to apply for loans or use their savings - how does your school assist in achieving return on this investment to ease student concerns about repayment? Are you clearly listing costs along with career and salary outcome data?

Institutional Alignment

- Look at your admissions process from an international candidate’s eyes - where and what are funding options listed? How many different offices, administrators, and resources are required?

- Is there pressure from leadership to increase enrollment? Help campus stakeholders understand that connecting students to funding sources helps with yield and diversification of cohorts to earn buy-in on website changes, marketing material updates, and perhaps scholarship resourcing!

- You don’t have to reinvent the wheel. Likely, funding resources exist across multiple departments. Can you consolidate?

- Revisit school policies and rules - how old are they? Where can they be tested or changed? Are there creative (and appropriate) ways to work around?

- Limited staff? Consider utilizing local experts and agents in market who provide region specific resources for students going abroad

Additional Resources

Example Website Language

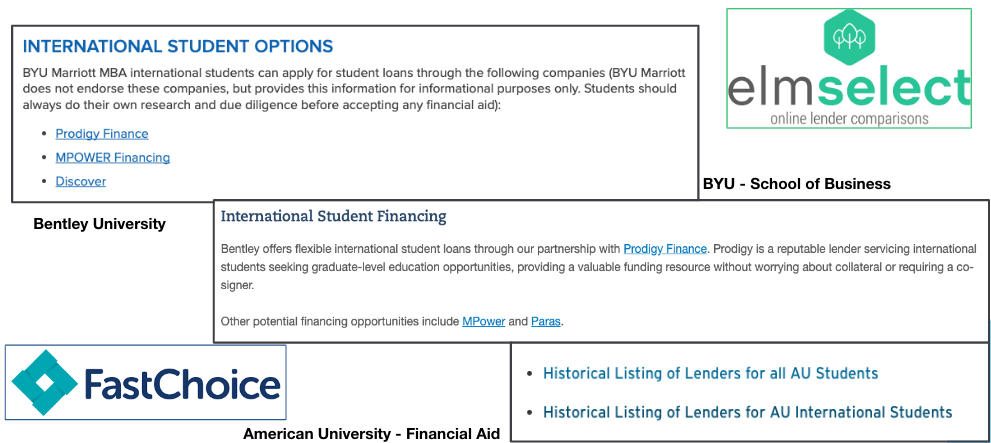

FastChoice and ElmSelect are lender comparison tools that provide students with all of their options. Both have a feature specifically for international and graduate students. Talk to your Financial Aid team to see if either of these, or a bespoke “historical lender list,” is being used and what can be added.

Scholarships and information for students

- US News and World Report: A Guide to Scholarships for International Students

- eduPass: Lists of Scholarships for International Students

- International Student: Sources of Financial Aid

The following NAGAP colleagues have presented on this topic at previous association events and have a wealth of knowledge and success in employing funding resources for increased international student numbers and diversity at their respective institutions:

- Katie Beczak – Assistant Dean of Graduate Student Success, Rochester Institute of Technology

- Andy Morris – Senior Associate Director for Enrollment Management and Recruitment, Binghamton University - SUNY

- Alyssa Orlando – Director, Graduate Admissions, Clark University

About Prodigy Finance

Prodigy Finance believes funding should not be a barrier to education. Top talent should be able to access top programs, regardless of their socioeconomic status. Over the last 15 years, Prodigy Finance has enabled 30,000 international graduate students from 133 nationalities to access their academic dreams through funding resources. 93% of our borrowers come from emerging markets and 90% report having limited or no other funding option.

Prodigy is proud to be a member of NAGAP and contribute to the international graduate student conversation while learning from this diverse and deeply experienced network. If you are interested in learning more about how Prodigy can support your international enrollment goals, please reach out to universities@prodigyfinance.com.

About Riane Corter

Riane Corter earned her M.Ed in Higher Education Administration from the University at Buffalo and has worked in the field for 13 years. Prior to joining Prodigy Finance, she worked at Siena College, UT Austin, and Duke University in various capacities, but the common thread was international education. Riane joined Prodigy Finance 4 years ago and is responsible for helping admissions and enrollment professionals understand the financial challenges faced by international graduate students and how they can support their aspirants with funding options.